Courtesy of SPIN farmer Brenda Sullivan, and husband Paul, in Glastonbury CTÂ

In today’s litigious society, being adequately insured should be a farmer’s top priority and,  very basically, the purpose and need for insurance is to protect the farmer from financial ruin. As a farmer/producer/vendor you are exposed to two types of risk:

- General Liability

- Product Liability

General Liability: These are the risks that are an inherent part of being a vendor at a market, which include: Trip and fall (i.e. – an injury resulting from tripping over a tent stake or other object). Unsecured equipment (i.e. an individual is injured when a gust of wind blows a tent onto him/her; display or table collapses onto someone causing injury etc.) In the event of a claim, a farmer could not only be financially responsible for the individual’s injuries but also for associated legal fees, which are often substantial. Bottom line, depending on the circumstances and the severity of the involved injuries, you could easily be exposed for significant damages that could extend into the six – seven $ figure range. Therefore, without sufficient liability insurance, a farmer /vendor could sustain significant losses, including the potential loss of their property / assets.

Product Liability: These risks are associated with the sale of your products at the market. Typically, the greatest risk involves food with the most common example being food poisoning.  Â

Why do Markets require their farmers/ producers/vendors to carry liability insurance?  When a claim is made, a frequent reality is that the “kitchen sink” mentality is applied – i.e.  in addition to the individual farmer / vendor, the Market itself is sued as well as the Market Manager and sometimes even the host town / county / State.  If a farmer does not have insurance, the Market and/or Market Manager would then bear the resulting financial responsibility for any claim. Given the all-volunteer nature of most Markets, this reality would significantly dampen the desire for anyone to volunteer as a Manager or Board of Director member.  That’s why in the State of Connecticut, all state certified Farmers’ Markets require every vendor to have a $1 million liability insurance policy, which includes product and general liability insurance. Farmers should contact the Department of Agriculture in their own state to confirm the specific minimum liability insurance requirements for Farmers Markets.  Note: Private markets on private property may not necessarily require that farmers / vendors carry liability insurance although it’s still a good idea to do so.

Food Safety: By engaging in food safety training, a farmer can demonstrate a pro-active level of responsibility for their products. In some states like Connecticut, food safety training is strongly recommended for all general produce farmers and is legally mandated if a farmer is selling any processed foods like jams, jellies, pickles etc. In addition, completing food safety training / obtaining certification from a nationally recognized organization like SafeServ might lower a farmer’s /vendor’s insurance premium. While there is no guarantee an insurer will offer a premium discount, food safety training is still an excellent investment.

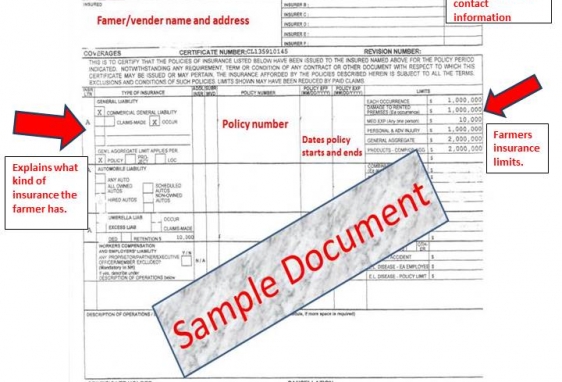

What is a Certificate of Liability Insurance and why do Farmer’s Market Managers require a market’s legal address to be listed in the Certificate Holders Section?  Above is a sample copy of a “Certificate of Liability Insurance”.Â

When a Market Manager requests a Certificate of Insurance naming the market as “Certificate Holder”, this is the document they are referring to. Every insurance agent will be familiar with this document as it’s standardized throughout the insurance industry.  An agent will customarily send a copy to you and/or the Market Manager at no additional cost. If they do charge for this, we recommend you seek insurance elsewhere. It’s important that the Certificate Holder section of the document list the legal address of the venue you are attending. The Market Manager will always look for this as well as for your policy amounts and the expiration date. The sections that need to be filled out are highlighted in red. However, other sections may also require completion depending on the type and amount of insurance a farmer/vendor may have.

Brenda Sullivan is the owner of Thompson Street Farm in South Glastonbury CT and the President/Market Master and one of the founding members of the Glastonbury Farmers Market Coalition Inc. Prior to starting her SPIN Farm, she was a Legal Assistant in the Legal Department at one of Connecticut’s largest Banks and her duties included working with a litigation attorney preparing cases for trial, many of which were insurance claims.    Brenda is married to Paul Sullivan, Vice President /Sr. Claim Consultant in the Risk Control and Claim Advocacy Practice at an International Insurance Brokerage Firm. In their respective careers, they have seen some pretty crazy claims made, many of which resulted in large settlements, even when liability was questionable. Â